how to calculate sales tax in oklahoma

The excise tax for new cars is 325 and for used cars the tax is 2000 for the first 150000 and 325 on the remainder of the sale price. Sales tax rates in Oklahoma vary depending on the county and.

Explore Our Example Of Eviction Notice Template Oklahoma 30 Day Eviction Notice Eviction Notice Family Tree Template Word

Depending on local municipalities the total tax rate can be as high as 115.

. Most transactions of goods or services between businesses are not subject to sales tax. Find your Oklahoma combined state and local tax rate. As a business owner selling taxable goods or services you act as an agent of the state of Oklahoma by collecting tax from purchasers and passing it along to the appropriate tax authority.

Calculate Sales Tax in Oklahoma Example New Car Initial Car Price. 325 of taxable value which decreases by 35 annually. To use our oklahoma salary tax calculator all you have to do is enter the necessary details and click on the calculate button.

Unlike VAT which is not imposed in the US sales tax is only enforced on retail purchases. Oklahoma collects a 325 state sales tax rate on the purchase of all vehicles. Enter zip codeof the sale location or the sales tax ratein percent Sales Tax Calculate By Tax Rateor calculate by zip code ZIP Code Calculate By ZIP Codeor manually enter sales tax Oklahoma QuickFacts.

450 Oklahoma State Sales Tax 200 Maximum Local Sales Tax 650 Maximum Possible Sales Tax 877 Average Local State Sales Tax. 325 of the purchase price or taxable value if different used vehicle. If you are based in Oklahoma and selling to a buyer with a ship to address in Oklahoma charge sales tax based on the sales tax rate at the ship to address.

Since this varies by city and county use the state sales tax rate of 45 045 plus the applicable city andor county rates. This means that depending on your location within Oklahoma the total tax you pay can be significantly higher than the 45 state sales tax. New and used all-terrain vehicles utility vehicles and off road motorcycles.

Item or service cost x sales tax in decimal form total sales tax. The cost for the first 1500 dollars is a flat 20 dollar fee. Sales tax in Canadian County Oklahoma is currently 485.

Typically the tax is determined by the purchase price of the vehicle given that the sale price falls within 20 of the average retail value of the car regardless of condition. To calculate the correct sales tax in Oklahoma you need to add up the state county and. If you are not based in Oklahoma but have sales tax nexus in Oklahoma you are considered an Oklahoma remote seller.

To calculate the correct sales tax in Oklahoma you need to add up the state county and city rates for your location. The tax calculation on a new car is straightforward. The sales tax rate for Canadian County was updated for the 2020 tax year this is the current sales tax rate we are using in the Canadian County Oklahoma Sales Tax Comparison Calculator for 202223.

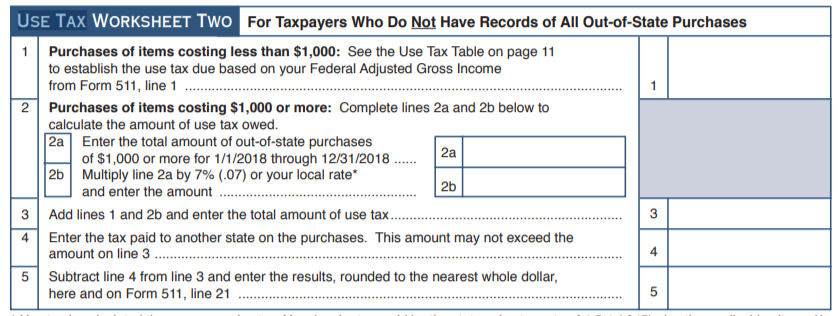

The easiest way to do this is to download our search tool to get the details you need in seconds. Multiply your Federal Adjusted Gross. The base state sales tax rate in Oklahoma is 45.

Oklahoma has a 45 statewide sales tax rate but also has 470 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 4242 on top of the state tax. Local tax rates in Oklahoma range from 0 to 7 making the sales tax range in Oklahoma 45 to 115. Oklahoma State Tax Quick Facts.

Tulsa in Oklahoma has a tax rate of 852 for 2022 this includes the Oklahoma Sales Tax Rate of 45 and Local Sales Tax Rates in Tulsa totaling 402. The sales tax rate ranges from 0 to 16 depending on the state and the type of good or service and all states differ in their enforcement of sales tax. Use tax is calculated at the same rate as sales tax.

325 of 65 of ½ the actual purchase pricecurrent value. 087 average effective rate. Sales tax is calculated by multiplying the purchase price by the sales tax rate to get the amount of sales tax due.

If this rate has been updated locally please contact us and we will update the sales. You can find more tax rates and allowances for Tulsa and Oklahoma in the 2022 Oklahoma Tax Tables. Do I Have to Pay Sales Tax on a Used Car.

325 of ½ the actual purchase pricecurrent value. If you do not know your city or county tax rate you can. The Oklahoma state sales tax rate is 45.

However it must be noted that the first 1500 dollars spent on the vehicle would not be taxed in the usual way. Sales Tax 50000 - 5000 - 1000 0325 Sales Tax 1430. Currently combined sales tax rates in Oklahoma range from 45 percent to 115 percent depending on the location of the sale.

Other local-level tax rates in the state of Oklahoma are quite complex compared against local-level tax rates in other states. How to Calculate Sales Tax in Oklahoma. The Oklahoma OK state sales tax rate is currently 45.

Oklahoma sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. By maisonreemanahar on February 24 2022. Typically the tax is determined by.

The base state sales tax rate in Oklahoma is 45.

Last Minute Dash When Where How To File Those Last Minute Tax Returns Tax Return Tax Paying Taxes

Loyal And Engaged Employees Are Enthusiastic About Their Work And Their Company And They Affect Other Employees How To Find Out Create Energy Customer Loyalty

How To Calculate Sales Tax Video Lesson Transcript Study Com

Checklist For Becoming A Free Business Consultation Coaching Business Consulting Business Consulting

Sales And Use Tax Rate Locator

South Carolina Retirement Tax Friendliness Smartasset Com Income Tax Brackets Retirement Retirement Income

Pin By Steeler Of The Day Dan Kreider On Aafc 1946 1949 Game Artwork Video Game Covers Video Games Artwork

Sales Visit Report Template Downloads 3 Templates Example Templates Example Report Template Templates Report Writing

Guide To Estate Sale Appraisal And Pricing Estate Sale Diy Estate Sale Estate Sale Planning

Santorini 3 Day Itinerary Food Beaches Views Sunsets Itsallbee Solo Travel Adventure Tips Greece Travel Guide Europe Travel Guide Us Travel Destinations

1108 W Oklahoma St Appleton Wi 54914 2 Beds 1 Bath Fenced In Yard Appleton Cozy Decor

Infographic Real Estate Is The Most Able Investment From Trang S Building Wealth In Real Estate Pr Real Estate Infographic Real Estate Postcards Investing

Oklahoma Sales Tax Small Business Guide Truic

Sales Tax The Complete Guide To Sales Tax In The United States Taxjar

State Lines Travel Info App Things To Know

Do I Owe Oklahoma Use Tax Support