san francisco payroll tax and gross receipts

Between now and early October when voting gets underway The San Diego Union-Tribune Editorial Board is planning to publish dozens of candidate QAs and nearly. Downtown San Jose is seeing only half the human activity of pre-pandemic times and San Franciscos core is not even a third of the way back to its former level according to new data.

Specifically the legislation reduces the gross income tax rate from 323 to 315 in 2023 and 2024.

. The business experienced a 50 decline in gross receipts during any quarter of 2020 versus the same quarter in 2019 andor a 20 decline in gross receipts 2021 against the same quarter in 2019. It is the largest sub-national economy in the world. The second one is the company must have had an average of 1 million or less in gross receipts every year.

If net corporate income tax receipts for the preceding fiscal year exceed 700 million the corporate income tax rate will be adjusted in such a way that when combined with all other applicable rates the tax rates would have generated net. It has also 5 cargo trucks. 210566 approved August 4 2021 effective September 4 2021.

Consumers wont be left out either as a new 7500 tax credit revamped from an existing 2008 tax credit will apply to new all-electric cars and another 4000 credit for used vehicles. Exemption provisions are listed in Section 954The most common exemption is for certain non-profit organizations. SAN JOSE is a non-VAT registered tax payer.

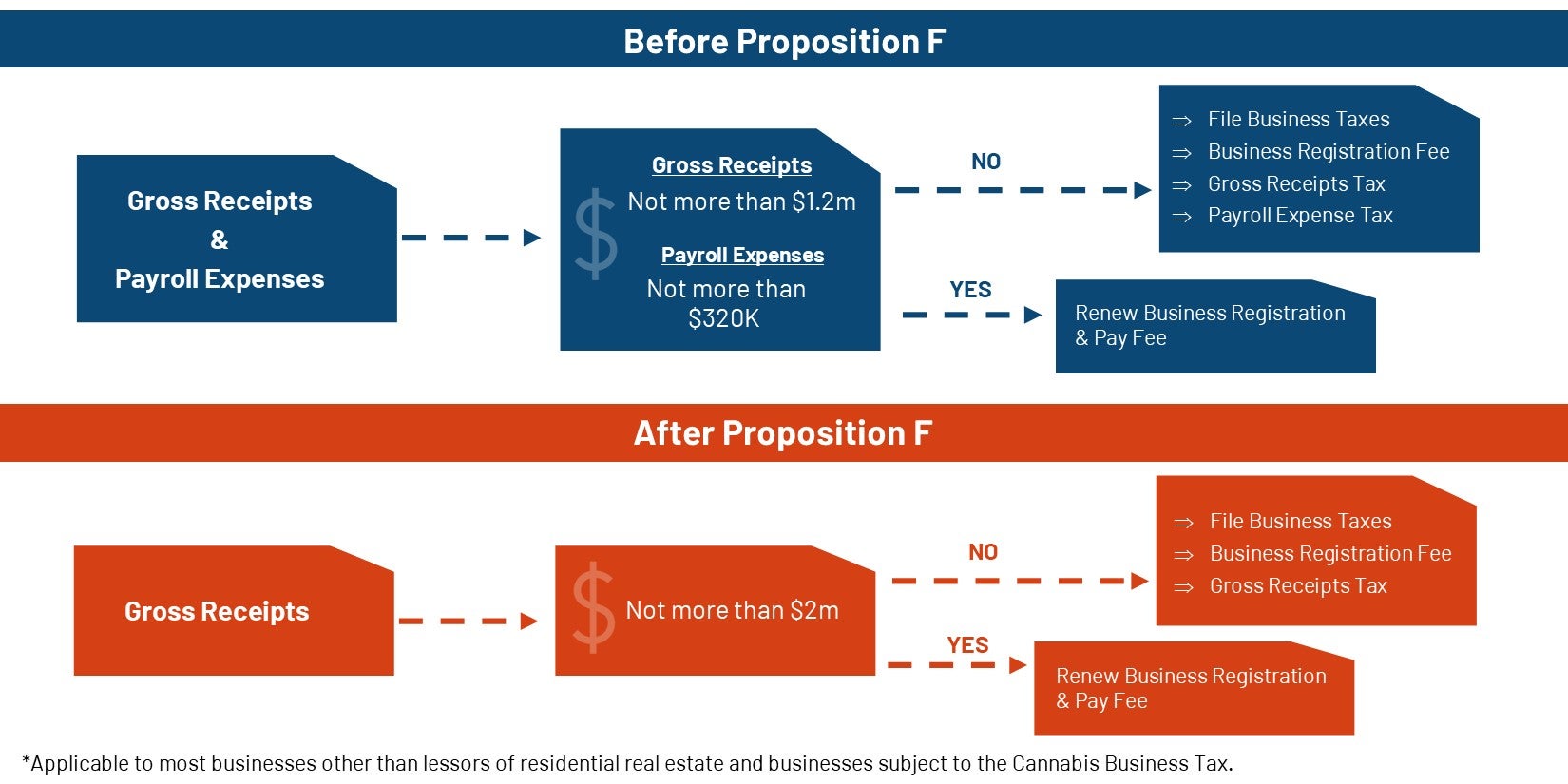

CA tax owed is 12590 800 LLC Tax plus an 11790 LLC fee if the income is more than 5000000 Just about all California LLCs and out of state LLCs that do business in California must pay the 800 a year franchise tax -- whether or not they did business or lost money. Occupation and Business License - Other. Persons other than lessors of residential real estate are required to file a return if in the tax year you were engaged in business in San Francisco were not otherwise exempt and you h ad more than 2000000in combined taxable San Francisco gross receipts.

General Sales and Gross Receipts. This online version of the San Francisco Municipal Code last amended by Ordinance 188-22 File No. The tax base and allowable expenditures vary depending on the design of the gross receipts tax.

Tax - PropertyOther Selective Sales. Division I of the Transportation Code was last amended by Ordinance 118-21 File No. Heres how it works.

AMERICAN LEGAL PUBLISHING CORPORATION 525 Vine Street Suite 310 Cincinnati Ohio 45202 800-445-5588 Fax. San Francisco California detailed profile. The company will calculate the difference between gross sales and reported tips at the end of each year or pay period.

If California were a sovereign nation 2022 it would rank as the worlds fifth largest economy behind Germany and ahead of India. Monthly full-time payroll Average yearly full-time wage Part-time employees Monthly part-time payroll. SAN JOSE an operator of 10 buses with provincial operations from Manila- San Mateo.

Texas Margin Tax allows for a choice of deducting compensation or the cost of goods sold. San Francisco Tax Deadlines. For 2018 the gross receipts from bus operations is P 1300000 and gross receipts from cargo truck is P 1200000.

How much is the total business taxes due. The economy of the State of California is the largest in the United States with a 34 trillion gross state product GSP as of 2021. Additionally Californias Silicon Valley is home to some of the.

Documentary and Stock. Nevada allows a firm to deduct 50 percent of its Commerce Tax liability over the previous four quarters from payments for the states payroll tax. If your business started in 2020 you will use 2020 as your comparison period when applying for the tax credit in 2021.

These allocated tips are listed separately on your W-2 under Box 8. Santa Monica Tax Deadlines. The Cannabis Business Tax was approved by San Francisco voters on November 6 2018 and becomes effective on January 1 2022.

News about San Diego California. If employee tips account for less than 8 of the companys gross receipts for that pay period the difference becomes allocated tips. In addition to the existing Gross Receipts Tax the Cannabis Business Tax imposes a gross receipts tax of 1 to 5 on the gross receipts from Cannabis Business Activities attributable to the City.

See the Comprehensive Ordinance Table for information regarding amendments to other portions of the San Francisco Municipal Code. 220756 approved August 4 2022 effective September 4 2022. So youre looking at 100000 tax credit on payroll taxes over the two quarters assuming you have seven or eight engineering employees making typical silicon valley wages.

San Francisco Gross Receipts Tax

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

What Is Gross Receipts Tax Overview States With Grt More

Homelessness Gross Receipts Tax

Annual Business Tax Returns 2021 Treasurer Tax Collector

32 Salary Slip Format Templates Word Templates For Free Download Word Template Payroll Template Bookkeeping Templates

San Francisco Gross Receipts Tax

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

Due Dates For San Francisco Gross Receipts Tax

How Much Proposition E Will Save Sf Startups Funwithmath Techcrunch

Does Your State Have A Gross Receipts Tax State Gross Receipts Taxes

San Francisco Taxes Filings Due February 28 2022 Pwc

Working From Home Can Save On Gross Receipts Taxes Grt Topia